I can’t count how many times I’ve come up with an idea and immediately said to my friends, “I should start a business!” I never do, but if I did, I know it would be online.

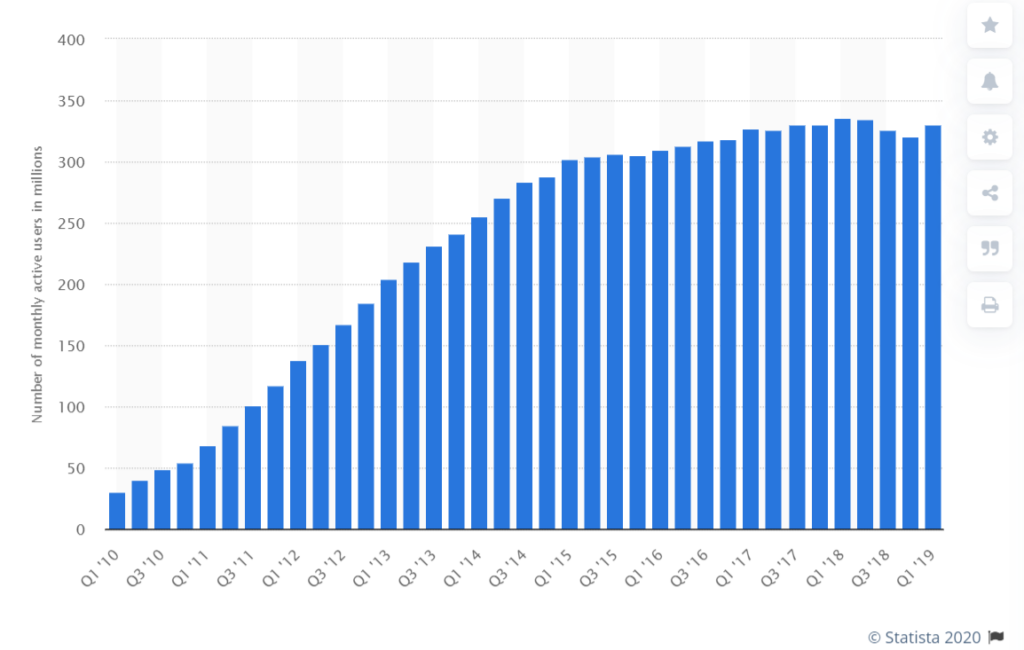

Why? Well, in 2018, online businesses generated over $2 billion in revenue. If shopping online wasn’t as popular a couple of years ago, it definitely is now.

Plus, online shopping makes the experience easier for the customer since they don’t have to leave their homes to make a purchase.

Another reason I would open an online store is because it would be easier for me. I could use online management systems to execute business functions and set up an ecommerce website to take the place of a brick-and-mortar shop. Aside from physical inventory, almost everything I would need could happen from a computer.

I haven’t yet landed on the online business idea that will catapult me into success, but you most likely have, and are itching to get going. There’s only one problem: where to start.

Starting a business is a hefty and challenging endeavor. Here, we’re going to focus on how to start one that operates online. If you’re interested in starting an online business, we’ve got you covered with these six steps.

There are some fun aspects of building a business — like picking out a name, creating your branding material, and connecting with leads. On the other hand, there are some aspects that aren’t as fun, like applying for business permits and filling out tax forms.

Here, we’ll explore both the easy and challenging aspects of starting an online business.

1. Create and fine-tune a business plan.

First, you’ll want to create a business plan. A business plan maps out the details of your company. It should serve as the point of reference for information about what your business sells, its structure, and how it will be run.

Business plans generally provide the important factors of your company, including financial projections, legal documentation, and leases or permits. It’s useful for stakeholders, who should be able to picture every facet of your business with the plan. Additionally, it’s a helpful resource for you, since it makes sure you don’t leave any stone unturned when creating your business.

Before you get going, keep in mind these best practices as you work through it. These will make sure your business plan is effective.

Think about how your business sets itself apart from competitors. If your industry is marketing, for example, how will your online marketing services be a better choice than the competition?

You may have to do a competitive analysis to find out how your business will stack up against other online stores. This simply means figuring out the strengths and weaknesses of your competition, so your business plan is accurate and realistic.

When you explain your selling points, stick to simplicity. The plan will cover your bases, so you don’t need to write a 1,000-word essay in each section if you don’t need it. For instance, skip detailing your entire paid ads strategy in this plan — just include that you intend to have one.

Ultimately, a business plan should be a quick point of reference.

Finally, remember that your business will function solely online, so some factors of your business won’t apply to a brick-and-mortar, like rent costs. Frame your plan so that it’s based online.

For an in-depth tutorial of how to create a business plan for ecommerce in particular, this post has you covered.

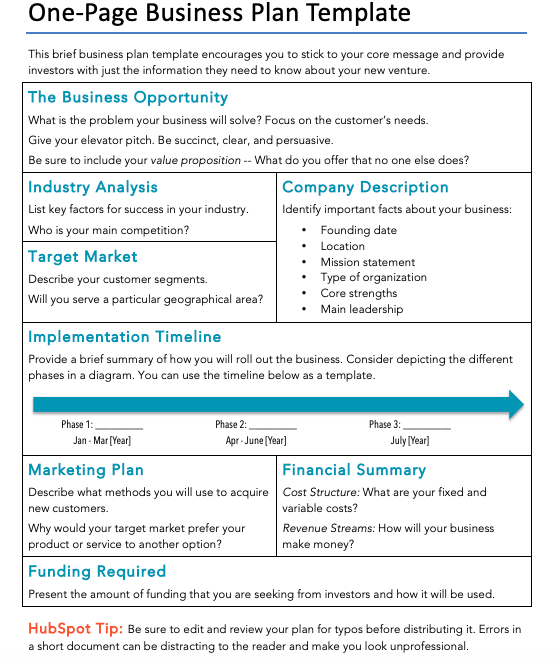

You can also download this free business plan template. Follow this quick tutorial below if you don’t feel quite ready to write one yet:

To summarize, a business plan will explain your company, its goals, customers, and why they should care. It will also include your product line and services, plan to sell online, and your legal structure. Finally, this’ll provide financial projections and business goals.

Below is an example of a business plan template. Yours doesn’t have to look like this, however. Just include the information needed.

Next, we’re going to get into something that, I’ll be honest, isn’t that fun. Even so, this step is critical for your online store to be able to operate. What I’m alluding to is the legal process, which includes identifying and registering your legal structure, business name, and obtaining a business license.

2. Build your legal structure.

At this point, your business plan is done and looks incredible. Next, let’s go over how to make your online company legal. You’ll have to fill out some paperwork, apply for licenses, and complete tax forms, but first, let’s identify your legal structure.

There are four different legal structures. You’ll want to keep in mind the online tax laws for your state as you move through this section. (Note, this is for U.S. businesses only).

- Sole proprietorship — This is a solo act, someone who runs a business by themselves. The government gives no restriction between the business and who owns it. This structure gives you the freedom to name the company after you without extra forms.

Tax information: The proprietor is responsible for every transaction. What that means is that your debts, liabilities, income, and losses are taxed on your personal income tax return at normal rates. You also are subject to payroll taxes and self-employment taxes on the money you earn.

- Partnership — A partnership is where two or more people are the owners and have equal shares in money spent and earned, like Ben & Jerry. Although partnerships are easy to form and may be cost-effective, every member has shared liability. You can vary this legal structure by having a limited liability partnership, or LLP, which protects business partners from the actions of others if a business goes south.

Tax information: Partnerships are formed by registering your business through your state. You can do this through your Secretary of State office.

- Limited liability company (LLC) — An LLC isn’t subject to a separate level of tax and is generally more complex than a sole proprietorship or partnership. Their complexity generally means a higher startup cost. LLC laws vary by state, but generally, most don’t restrict ownership, so you can partner with another business if you desire.

Tax information: LLCs benefit from a flow-through tax treatment. This means that the owners of the LLC are taxed, not the business itself, which makes taxes easier.

For more information on taxes and IRS tax forms, follow this link. Otherwise, now that you’ve identified your legal structure, you can file those forms and make your business structure legal.

Next, you’ll want to register a name.

3. Pick your business name and register it.

Have you picked out your name yet? That was probably the easiest part of starting your online business, right? Well, now you have to register it to make sure that your amazing name remains in your ownership.

First, make sure the name is available in your state for an ecommerce business, and obtain a trademark. These stipulations will protect your name from being stolen and make sure you don’t have the same name as another online store.

If your business is an LLC, your name will be registered when you register your business. If you are part of a smaller structure, however, you will have to register a “Doing Business As” name, which just distinguishes the owner(s) from the business name.

You can usually register your business name for under $50. Recall that trademarks protect your business’s name, and usually cost less than $300. You can learn how to register that trademark here.

4. Obtain your business permits and licenses.

Here’s what you need to know about permits for an online business and why you need them. We’ll also include tax information to take note of. (Don’t worry, we’re almost through the legal side of things.)

- Seller’s permit — You’ll need a seller’s permit to sell products online. This permit allows for the sale of physical goods or services, such as clothing or books. Even though your business will be online, you’ll still need a seller’s permit to collect sales tax from customers.

- Business license — Nearly every business needs some sort of license to run legally, but some states require additional licenses. To make sure you have every license that you need to operate within your state, visit this website.

- Small Business Tax — If you are the owner of a business, you’ll be required to pay federal taxes, which are determined by your form of business. Excluding partnerships, you’ll need to file an annual income tax return (partnerships file an information return).

- Self-Employment Tax (SE Tax) — This is one of the taxes you could have to pay within your state. It’s a Social Security and Medicare tax for those who are self-employed, like business owners. If your net earnings are more than $400, you’ll have to file a 1040 as well, but don’t worry, here’s where you can learn more about SE tax.

- Employment Tax — If you hire employees, you need to file certain employment tax forms that protect you and your team. These tax forms include benefit taxes, federal income tax withholding, and federal unemployment tax. Click here to learn more about Employment Tax.

- Excise Tax — Depending on what you sell and your location, you might need to file for Excise taxes. For instance, some industries require a federal excise tax. To figure out if your products or services qualify for this tax.

To apply for a seller’s permit, visit the website of your state’s Department of Revenue. And don’t worry about an application fee, these permits are free to obtain.

U.S. businesses need an Employer Identification Number (EIN), and after you register for one, you’ll be able to see what taxes you’ll need to file. The three types of taxes you can be taxed for are Self-Employment, Employment, and Excise, explained above.

That was a lot of information; are you still with me? I hope you are, because that means you’re done with registering your online business with the government and have permission to operate legally. That wasn’t so bad, right?

So, you’re ready to be open for business! Now, let’s talk about getting that business. For online businesses, your online presence is key, and how you can begin to build your customer base.

You’ll need to find some sort of demand for your product before you can receive funding, so you’ll have to generate customers and keep them. For now, let’s talk marketing.

5. Plan how to market the business.

There’s a bunch of information on the internet about how to market an online business, but this section will focus on the essentials you should absolutely have, regardless of the software or platforms you use.

.png)

1. An Audience

If you don’t know who you’re marketing to, your marketing messages will be misguided. Who will be interested in your product?

You might have a general idea, like the location or age-range of your customer. Now, really flesh out your ideal customer if you haven’t already. Think of what makes them tick — their interests, challenges, goals, age, and, most importantly, their web behavior.

Additionally, you need to be knowledgeable about the social platforms your target audience frequents and why, so you can idealize how your store aligns with their online shopping habits. You also must know how your business will fit into their web routines so you can target the right people. Refer to this guide about how to identify your target customer with a buyer persona.

2. Online Brand Identity

A buyer persona is a fictional account of your ideal customer, and provides information about them that will help you frame marketing messages. Concurrently to finding your target customer, you’ll want to build your brand identity.

Brand identity defines how you want customers to feel when interacting with your business, and promotes your company values. What do you want customers to feel or think of when they think of your business? That’s what a brand identity conveys.

3. Social Media Accounts

Social media accounts will be the mascots for your brand identity. You can make them according to your brand colors, audience, mission, and values. For instance, let’s look at HubSpot’s Instagram and identify some brand themes:

Source

What sticks out to you? Whether it’s the color orange, the sprocket logo, or the tagline — all these factors support HubSpot’s brand.

When you make social media accounts, stick to the platforms that support your business goals. This’ll focus your marketing efforts and make sure you’re engaging with your target audience. For instance, Instagram is a visual platform, LinkedIn is a networking channel, and Twitter and Facebook successfully support a mix of long and short-form text.

4. A Professional Website

Additionally, if you’re opening an online business, you’ll need to have a website or online store.

You must make sure your website is easy to navigate and make purchases. When you online shop, what are some features you notice on websites that you can implement on yours to delight customers?

Additionally, there are some website best practices to consider — like ensuring your website is mobile-responsive.

After purchasing a domain, you can build your website on your own, hire a web developer, or work with software that’ll help you set up your website. The design is up to you, but remember to keep the customer experience your top priority.

Some ecommerce software, like Shopify, provide templates for building an ecommerce website, which is useful because you can set up your website and shopping cart software at the same time. This is an in-depth tutorial on how to set up ecommerce on your website, it provides resources for how to make one that glows.

5. Online Selling Capabilities

After setting up your website, don’t forget to find software that’ll help you execute online marketing functions, such as email, conversion, and social media. To streamline these processes, look for an all-in-one content management system, like HubSpot, to keep you organized. Check that your website is compliant with all ecommerce laws, such as COPPA, and Payment Card Industry (PCI).

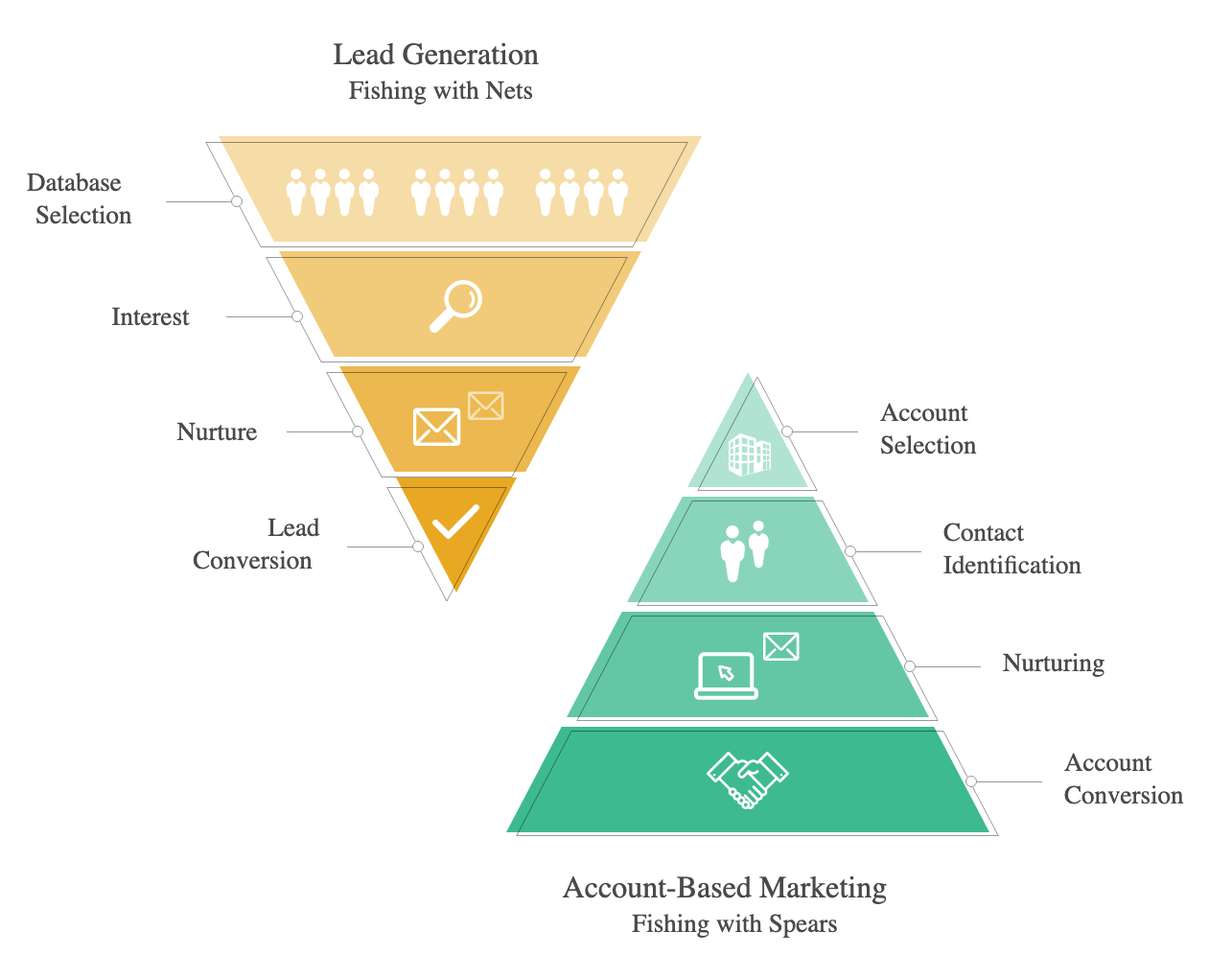

Once you’ve built your website, social media profiles, and have the necessary tools set in place, you can start generating leads. Lead generation defines the process of turning strangers into prospective customers. Successful lead generation methods keeps your sales options plentiful.

Want to know more about lead generation? We’ve got you covered with this lead generation ultimate guide. Pro tip: Some content management systems offer lead generation tools built into their product, so be sure the one you choose does to keep costs as minimal as possible.

Selling your products or services online

Remember those management software systems mentioned earlier? They’ll really come in handy when you set up your sales structure. They give you a homebase where you can keep client information.

Next, you’ll need to figure out your sales goals. The question you’ll have to answer here is, “How much do I need to make to keep running my business, and how much do I need to sell to earn that number?” You’ll need to do a little budgeting, and for some help there, check out this quick read on budgeting for small businesses.

You’ll also want to hire a sales rep. When you’re a small business owner, you have to think about the essential hires to make, and a sales rep is one of them. You need a person dedicated to understanding your customer and selling to them.

When you hire a sales rep, make sure they’re familiar with ecommerce practices and your audience. They should be able to follow the sales process you’ve put together. To cut down on the tedious tasks of the job, like data entry, you can automate sales tasks so your sales rep can spend more time focusing on other duties.

Be aware of web-specific laws, such as payment gateways and shipping restrictions. A payment gateway is a medium that authorizes credit card payments. For example, when you make a purchase online and see the types of credit cards supported, that’s a description of the payment gateways on that site.

Common ecommerce tools have payment gateways built into their system and support methods from PayPal to AmEx, so check to see what yours provides. When you choose payment gateways, go with the most common choices, such as major credit card providers and an app or two, like Afterpay.

After payments are processed, the product is ready to ship, so be conscientious about shipping laws. These are dependent on your product and your area, so go with a wholesale manufacturer or dropshipper that supports your product when you’re product sourcing.

(For instance, if you sell nail polish or alcohol, you might want to look outside of USPS, because they have restrictions on the shipping of those products). If you’re wondering how much you should charge for shipping based on what you have to pay for shipping, check back to this pricing strategy guide to make sure you and your customers are getting the best deals.

When analyzing your performance and sales, make sure you have analytics software downloaded, otherwise, you won’t be able to measure your success. This software monitors activity in your store and gives you metric reports that detail sales, time spent on your site, etc.

6. Set up your funding plan.

Small businesses need funding or some sort of capital in order to turn a profit consistently. If you can finance your business solo, or with help from friends, that’s called bootstrapping, and can eliminate the need to seek additional funding.

If, however, you need to look for additional funding, here’s the options for startup capital:

- Crowdfunding — You may have heard success stories of businesses that get funding through platforms like Kickstarter. That’s called crowdfunding, and it’s how to get funding from potential customers who take interest in your business idea in exchange for a perk, like early access to your first launch. You can learn more about how to successfully crowdfund in this post.

- Accelerator — If you go the accelerator route, you’ll be involved in a process that involves going against other small businesses in a pitch event. The winning business typically wins funding, seed, and capital. This is also an excellent opportunity to network with other businesses.

- Small Business Loan — If you’re really set on your budget and how you’ll spend the money you need, you may be able to get a small business loan from a bank or lending institution. Before you start reaching out to possible investment opportunities, do some research on the different offerings and make sure every cent in your business plan is accounted for.

- Seed — Seed financing means that whoever invests in your company will get a share of stock in return. There are a couple of different types of seed financing, but this is the general idea. Keep in mind that if your business gets sold, investors will most likely want their investment back.

Investments can help you with different costs that are essential to running a business online, but too expensive for out-of-pocket purchases. For instance, you have to pay to ship out your products, and you need money for that. Also, a paid ad strategy gets your business out there online, but you might need extra funds to make a successful one.

Migrating your business online

If you find yourself in a place where you have to migrate your business to online, don’t panic. Instead, make a plan. Let’s go over some best practices for successful migration.

First, think about the practices you’re already performing online and how you can expand on them. For instance, do you already use software to help you manage sales? See what else that software offers to help you succeed online. You might not need to invest in extra tools to make the migration.

Next, make sure that your business has filed the necessary paperwork in order to sell online. Your state might require an extra licensure or tax for ecommerce.

Then, follow the steps needed to move to ecommerce. You might need to download an extension, like Shopify, to allow selling on your site. Refer to these resources on ecommerce practices to help you out.

Make sure to let your customers know about your migration and use your best customer service skills to help them navigate the changes. This will keep your customers coming back, even online.

Check your performance metrics to see how the migration is affecting your data. After you migrate, keep a close eye on them to figure out areas by which to improve your customer experience.

Most of all, be patient and calm. Migrating can be a tough process, but you’re not alone by any means. Take your time to provide the best experience for your staff and customers, and you’ll see success on the other side.

We’ve gone over everything you need to know about starting your online business, from business planning, to legal forms, marketing, and sales. I’m still working on my winning idea, but for now, you’re fully ready to get going on yours. Good luck!

![]() REF: Hubspot

REF: Hubspot